- China bans chips from Micron Technology

- Ban may have limited impact as it applies mostly to public sector

- Micron to invest 500 billion JPY in Japan, receive financial incentives

- Inventory write-downs amid market glut pressure earnings

- Company expects stabilization in fiscal-Q3

- Stock gains amid euphoria triggered by NVIDIA earnings

Micron Technology (MU.US) made it to the news headlines at the beginning of the week after China banned some products from the company on the back of security reasons. This is another chapter in US-China tech wars and may weigh on company's sales. However, Micron announced a big investment in Japan recently, which may help offset woes in China. Let's take a quick look at recent news on the company.

China bans Micron chips

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appCyberspace Administration of China, Chinese cybersecurity regulator, said in a statement on Sunday that some products of Micron Technology, US memory chip manufacturer, failed to pass security tests. Regulator said that products from Micron pose a significant risk to the critical information infrastructure supply chain and, as such, companies involved in critical information infrastructure projects should stop using them.

The move can be seen as another chapter in the Sino-US trade war and a retaliation from China. The United States has been restricting chip exports to China and targeting Chinese tech companies, like for example Huawei, on the back of security reasons for years. Undoubtedly, the decision is primarily driven by politics rather than security concerns. This seems especially true given that it was announced shortly after the G7 summit during which G7 leaders voiced their concerns over China and called for reduction of dependence on China in critical supply chains.

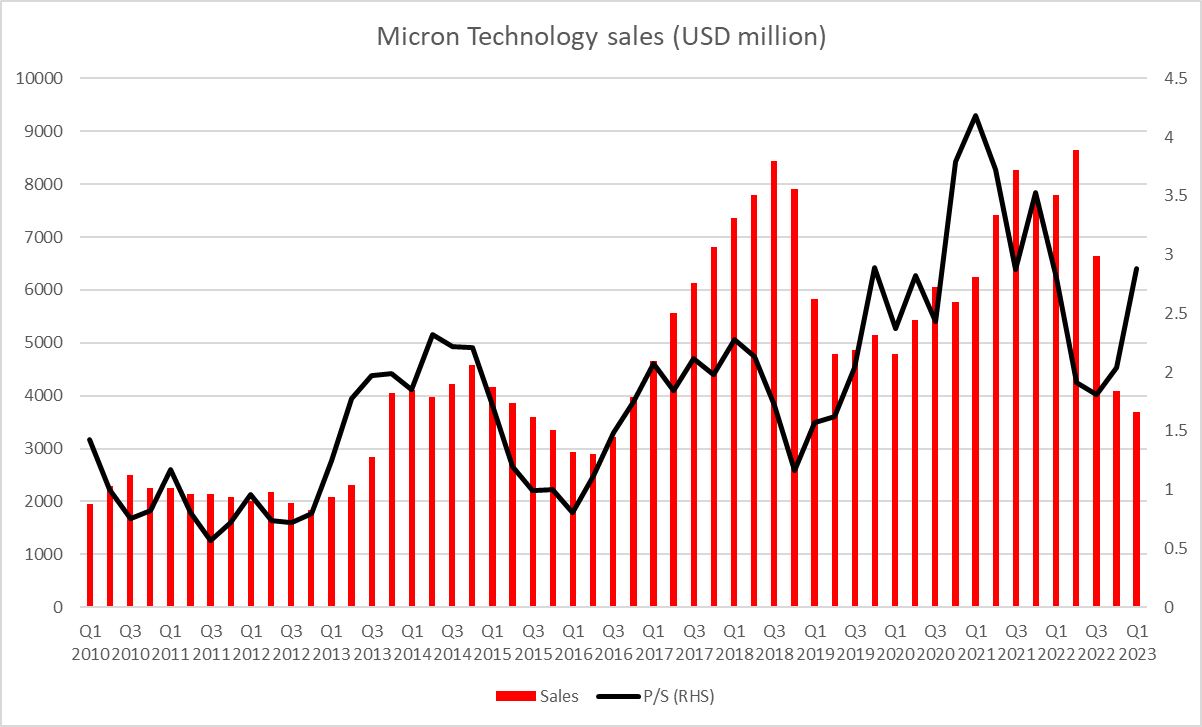

Sales of Micron Technologies have been under pressure in recent quarters amid a glut on the memory chip market. Source: Bloomberg, XTB

Sales of Micron Technologies have been under pressure in recent quarters amid a glut on the memory chip market. Source: Bloomberg, XTB

Limited impact of Chinese ban?

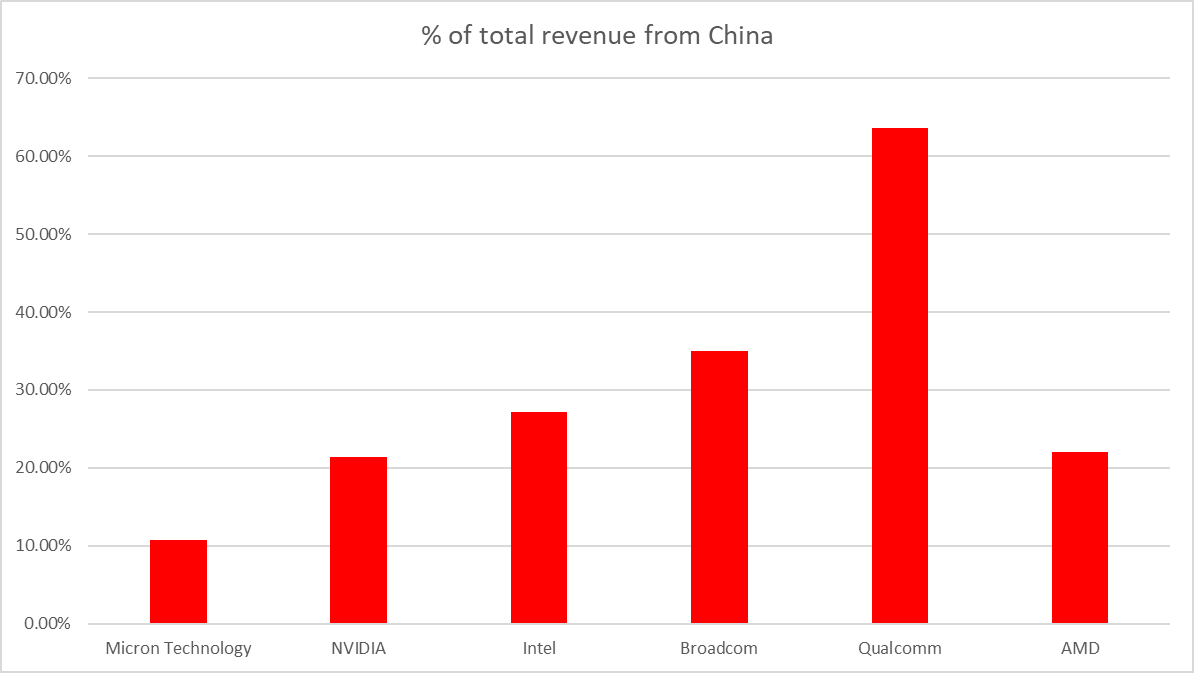

While China is responsible for around 11% of Micron revenues, company said that around a quarter of its revenue came from Chinese companies in the form of direct or indirect sales. However, the impact of the Chinese ban is actually likely to be much smaller. China has banned use of Micron chips in domestic critical information infrastructure projects. This is a field limited mostly to the public sector - government and telecommunication companies - which account for a fraction of a company's sales as Micron sells mostly to the private sector in China. While it is not yet sure how China will define critical information infrastructure and therefore its hard to assess impact of the ban, Micron says a ban could cost it as much as "high single digit" percentage of annual revenue.

While China accounts for 11% of Micron's direct sales, the company said that direct and indirect sales to Chinese companies combined may account for as much as a quarter of its revenue. Source: XTB

While China accounts for 11% of Micron's direct sales, the company said that direct and indirect sales to Chinese companies combined may account for as much as a quarter of its revenue. Source: XTB

Micron invests in Japan, Japan offers incentives

While the Chinese decision to ban use of Micron chips in critical information infrastructure will negatively impact the company's business, there was also some positive news on the US chipmaker recently. Namely, Micron announced that it will invest as much as 500 billion JPY (around $3.75 billion) in Japan with Japan offering around 200 billion JPY (around $1.5 billion) in financial incentives to the company.

Micron sees improving outlook for its business

Micron Technology business has been struggling recently - sales were dropping amid a glut on the memory chip market and it has also had a negative impact on profits. Micron reported net loss for the two previous quarters with net loss in fiscal-Q2 2023 amounting to $2.1 billion. However, it should be said that it was driven primarily by a $1.43 billion inventory write-down. Nevertheless, the company said it expects things to improve going forward. While guidance for fiscal-Q3 does not show such improvement, it does not point to further deterioration either. Micron expects fiscal-Q3 results to be more or less unchanged from fiscal-Q2 and to also be impacted by inventory write-down, although of smaller magnitude (around $500 million). A return to profitability is not expected until mid-2024.

Glut on memory chip market and weakening demand have taken a toll on Micron's earnings with massive inventory write-downs pressuring earnings. Souce: Bloomberg, XTB

A look at the chart

China's decision to ban Micron products led to an almost-4% bearish price gap on the company's stock at the beginning of Monday's cash trading on Wall Street. Whole semiconductor sector was under pressure on Monday. However, strong gains can be spotted across semiconductor stock today, thanks to a stellar earnings report from Nvidia released yesterday. Micron Technology (MU.US) is set to launch today's trading at the highest level since June 8, 2023. From a technical point of view, outlook for company's stock is bullish with share price breaking above the upper limit of an ascending triangle pattern at the end of the previous week. A textbook range of an upside breakout from this pattern points to a possibility of an upward move to as high as $81.50 - level not seen since late-March 2022. However, in order to reach these levels, bulls would need to break above a mid-term resistance zone in $74.25 the area.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.