Amazon has shown very solid Q1 2024 results, once again surpassing analysts' expectations, both in terms of revenue and earnings per share (EPS). The company reported very good results for AWS cloud sales, but on the other hand, the company provided fairly conservative guidance for the next quarter. Despite this, the company's strong performance is leading to an increase in stock prices after the session, reminiscent of the situation with Microsoft and Alphabet's earnings releases. Both of these companies have (at least partially) similar businesses. Here is a summary of the key points and their impact on stock prices:

Positive aspects:

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Revenue: $143.3 billion, surpassing expectations of $142.6 billion. This is a significant year-over-year increase compared to $127.4 billion in Q1 2023.

- EPS: $0.98, surpassing expectations of $0.84. This is a significant jump compared to $0.31 in Q1 2023.

- Strong growth in all sectors: Online sales revenue increased as expected. AWS revenue also exceeded expectations, showing even stronger growth of 17% compared to the expected 14.7%. AWS revenue reached $25 billion. Advertising revenue is also on a growth trajectory, which may begin to generate a significant portion of revenue in the future.

- North American sales increased by 12% YoY to $86.3 billion.

- International sales increased by 10% to $31.9 billion, up 11% excluding currency impact.

- The company also plans to invest $750 million to ensure the security of its services.

Mixed signals:

- Q2 sales forecast: Amazon's sales forecast for Q2 of $144 to $149 billion falls short of analysts' expectations of $150.13 billion. However, mixed sales expectations take into account the negative currency impact.

- Operating income: Expected operating income range of $10 to $14 billion, when market expected $12.56 billion.

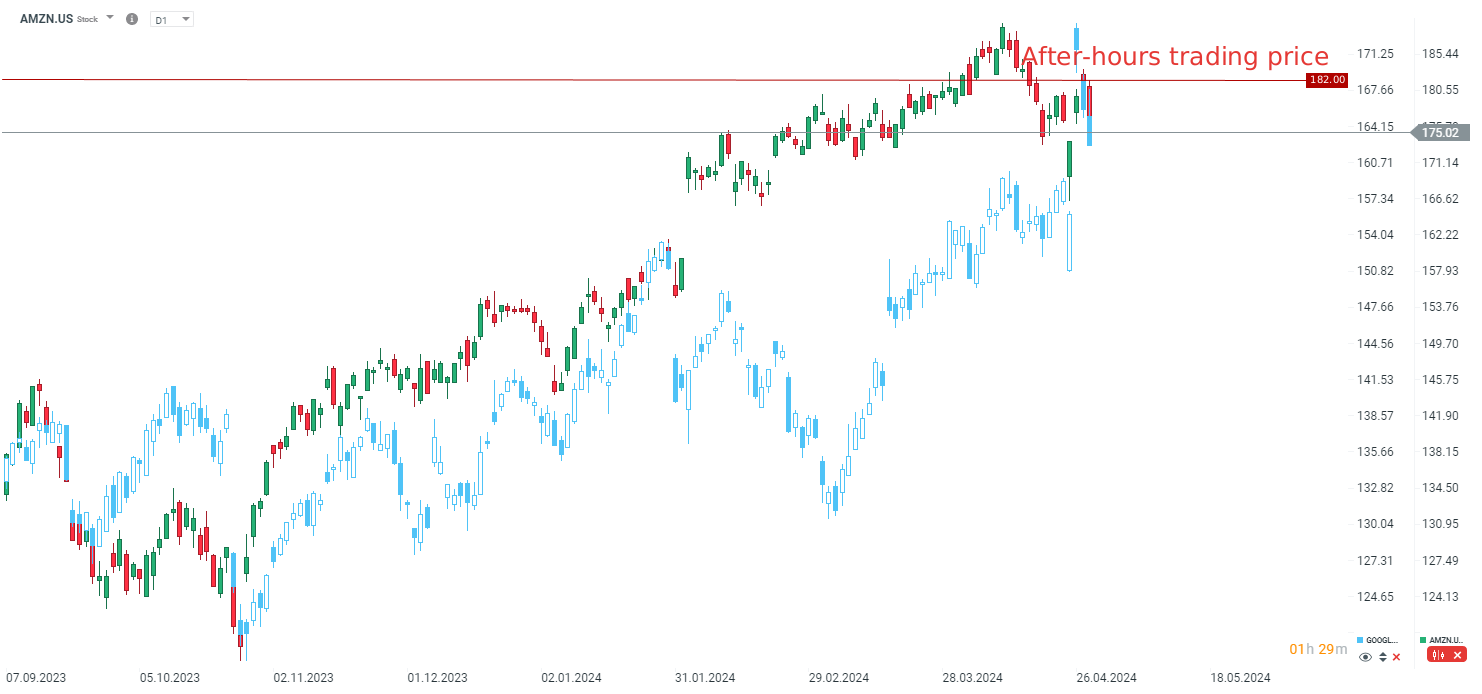

Amazon's Q1 2024 results were positive, indicating continued growth in all key areas of business. The company shows solid growth in the cloud segment and in the key sales segment. Of course, the company did not meet expectations for guidance, but it is worth noting that it cites currency exchange as the reason. Furthermore, in previous quarters, the company usually significantly exceeded its initial expectations. The company's stock gained 4.5% in after-hours trading.

The price has jumped in after-hours session. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.